Disclaimer: This article is for educational and informational purposes only and should not be taken as financial, legal, or investment advice. Credit Leverage X does not guarantee specific funding outcomes. Always consult with a licensed financial professional before making financial decisions.

For many business owners, debt is not the problem — the cost of debt is. High interest rates, compounding balances, and short repayment terms can choke growth potential.

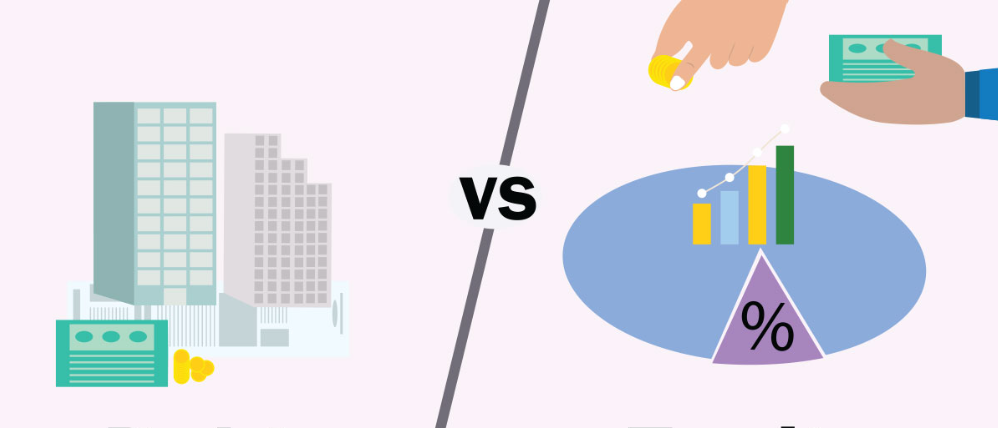

But what if you could refinance your existing business debt with 0% APR funding, effectively resetting your financial clock and freeing up cash flow for expansion?

That’s the power of credit leverage — the strategic use of funding tools to restructure liabilities, lower interest payments, and redirect capital toward growth.

In this in-depth guide, we’ll break down how 0% APR refinancing works, how entrepreneurs use it to consolidate or eliminate high-interest debt, and how Credit Leverage X (CLX) helps businesses transform debt into scalable financial leverage.

Before exploring refinancing, it’s essential to understand how traditional debt holds businesses back.

Short-term loans – quick funding but high daily/weekly payments.

Merchant cash advances (MCAs) – rapid approvals but interest rates can exceed 40%.

Equipment financing – long-term commitments that affect cash flow.

Credit cards and revolving accounts – manageable when used right, dangerous when mismanaged.

The reality: even profitable businesses can struggle when interest eats into margins.

A small business with $80,000 in MCA and card debt at an average 22% APR pays nearly $1,467/month in interest alone.

Now imagine replacing that with 0% APR business credit for 12–18 months — interest drops to $0, freeing cash for reinvestment and growth.

0% APR funding refers to credit lines or business credit cards that offer introductory periods (usually 12–18 months) with no interest charges.

This funding can be used to:

Pay off high-interest loans or credit cards.

Consolidate multiple debts into one manageable structure.

Reallocate funds toward cash-generating activities.

After the introductory period, balances can be refinanced again — creating a rolling leverage system that maintains liquidity and credit health.

Refinancing is not about avoiding repayment. It’s about resetting the financial equation to give your business breathing room and strategic capital control.

Assess Current Debt Portfolio

Identify which debts have the highest interest rates and shortest repayment terms.

Secure 0% APR Funding

Apply for new business credit cards or lines with promotional interest-free periods.

Transfer Balances or Pay Down Debt

Use new credit to eliminate high-interest accounts. This instantly stops interest accrual.

Rebuild and Reinvest

With reduced payment obligations, redirect cash flow into marketing, automation, or expansion.

Cycle Strategically

Before the 0% term expires, repeat the process or pay down balances completely.

CLX calls this the “Capital Recycling Method” — a system designed to keep money working instead of compounding against you.

No interest for 12–18 months means every dollar goes toward principal — not lenders.

With lower monthly obligations, you can reallocate funds to operations or growth initiatives.

Strategic refinancing can lower utilization ratios, increasing your personal and business credit scores.

Fewer accounts mean easier management and less missed-payment risk.

When cash isn’t tied up in interest, it can be reinvested into scaling the business — from inventory to digital marketing.

Most business owners don’t realize that 0% APR funding isn’t limited to startups or elite borrowers — it’s available to anyone with structured credit.

Credit Profile Optimization

CLX analyzes personal and business credit profiles to raise FICO and Paydex scores above funding thresholds (typically 700+ personal).

Strategic Application Sequencing

CLX submits multiple funding applications across different lenders within a 30-day window to stack approvals ($50K–$250K+) without damaging scores.

Debt Analysis and Allocation

Existing debts are reviewed to identify high-interest targets for immediate refinancing.

0% APR Funding Deployment

Funds are strategically used to pay off or transfer balances — lowering utilization and stopping interest growth.

Ongoing Mentorship and Management

CLX mentors clients on maintaining low utilization, managing repayment cycles, and preparing for future funding rounds.

This process transforms reactive debt management into a proactive credit strategy.

These funds should go toward debt reduction or investments that generate ROI — not daily expenses.

Always track the 0% APR term. Missing the cutoff can trigger high penalty rates.

This can increase personal utilization and limit future funding. Always separate accounts.

Paying just the minimum delays debt elimination. Allocate cash flow to maximize principal reduction during the interest-free window.

Funding systems are complex — professional help ensures proper sequencing, structure, and compliance.

Scenario:

A CLX client, an eCommerce business owner, carried $120,000 in high-interest debt across 5 credit accounts averaging 22% APR.

Before CLX:

Monthly interest: $2,200

DSCR: 0.9 (below lender standards)

Utilization: 85%

After CLX’s Refinancing Strategy:

Secured $150K in 0% APR business funding.

Paid off all high-interest debt immediately.

Reduced utilization to 15%.

Freed up $2,200 monthly for advertising and operations.

Within 9 months, the client’s monthly revenue doubled, and their business qualified for an additional $200K in working capital.

This is the compounding power of smart leverage — not borrowing to survive, but borrowing to thrive.

You should consider refinancing with 0% APR funding if:

You’re paying more than 10% APR on existing debt.

Your business has multiple revolving accounts with varying due dates.

You want to improve credit scores and free up cash flow.

You’re planning expansion but can’t access new capital due to debt load.

CLX’s experts perform a free funding audit to assess your current debt profile and determine if 0% APR refinancing is right for you.

Refinancing is just the beginning. The ultimate goal is to transition from debt dependence to funding mastery.

Through CLX’s mentorship programs, clients learn how to:

Maintain revolving lines of credit responsibly.

Reinvest profits into income-generating assets.

Build business credit scores for larger approvals.

Access private lending and investment capital.

This journey transforms short-term debt relief into long-term wealth building.

Refinancing business debt with 0% APR funding can dramatically lower interest costs and boost cash flow.

Always use new credit strategically — focus on debt elimination and growth reinvestment.

The Credit Leverage X framework provides structure, sequencing, and mentorship to help entrepreneurs secure $50K–$250K+ in 0% APR capital.

Refinancing isn’t an escape — it’s a financial evolution.

Book a no-cost strategy call and get expert guidance, personalized solutions, and real opportunities to move your goals forward.

Get StartedMost lenders require a personal credit score of 680+, but CLX helps clients raise and optimize their profiles before applying.

Yes — for the promotional period (typically 12–18 months). After that, standard APR applies unless refinanced again.

Clients typically access $50K–$250K, depending on credit and business structure.

CLX sequences applications strategically to minimize inquiries and maintain score integrity.

Yes. Consolidation is one of the main benefits of 0% APR funding.

A better credit score starts with the right strategy. Let Credit Leverage X help you take control of your finances, improve your credit, and unlock the funding you deserve.

Start Your Credit Strategy

Subscribe now to keep reading and get access to the full archive.